[ad_1]

The U.S. Securities and Exchange Commission (SEC) made a shock assault on the Ripple case by submitting a letter of supplemental authority to strike Ripple’s “fair notice” protection. Simultaneously, the token XRP is down 2.33% within the final 24 hours to $0.7 following the market’s downtrend.

The SEC’s Surprise Move

As the favored SEC vs. Ripple case is predicted to be resolved round April this 12 months, the SEC has made a brand new transfer that left many questioning if earlier expectations may change.

The American regulator is utilizing a successful transfer from one other case to strike at Ripple’s key arguments.

The SEC had taken John M Fife and 5 entities managed by him to courtroom in September 2020 for promoting $21 billion of penny shares and gaining a revenue of $61 billion with out registering as safety sellers.

FIFE’s protection adopted an argument much like Ripple’s, alleging the SEC hadn’t given them a good warning and the time period “dealer” will be extensively interpreted. Last month, the courtroom denied this argument.

What Does It Mean For The Ripple Case?

Naturally, the regulator now aimed to make use of this denial to strike at Ripple’s “fair notice” key protection.

Similarly, Ripple’s “fair notice” protection alleges the regulator did not notify them a couple of potential violation of federal securities legal guidelines and claimed the time period “investment contract” is being misused by the SEC, adding that “The SEC’s theory, that XRP is an investment contract, is wrong on the facts, the law and the equities.”

No overseas regulator has decided that XRP is a safety. In truth simply the alternative is true. The U.S. can be the unlucky outlier.

The SEC is utilizing the FIFE case newest final result to insist that the time period “investment contract” is sure by authorized parameters since 1946:

In Ripple’s case, binding authority construing the time period “investment contract” has existed since 1946. W.J. Howey Co., 328 U.S. at 298–99. Thus, Fife gives further authority for putting Ripple’s fourth affirmative protection.

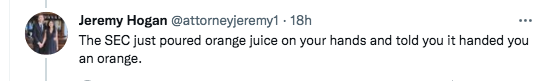

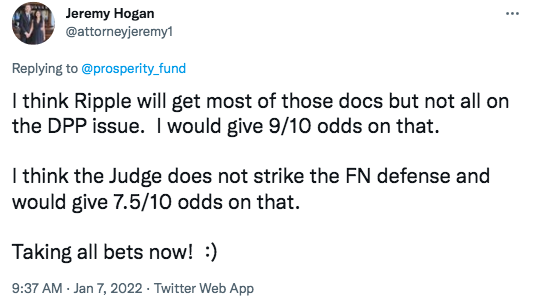

However, the instances have distinct phrases. The legal professional Jeremy Hogan explained through Twitter that the FIFE case final result “marginally helps the SEC’s position in its Motion to Strike Ripple’s Fair Notice Defense so the SEC filed it with the court.”

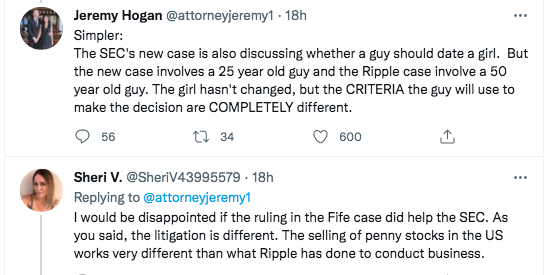

Although the SEC is making an attempt to make a transfer out of the similarities from each instances, Hogan claims that FIFE’s “was in a really totally different stage of litigation and the usual is totally totally different than the SEC v. Ripple case.

In the “Fife” case, the Defendant tried to argue “Fair Notice” as a way to dismiss the lawsuit fully (and failed) as a result of the burden may be very excessive on a celebration transferring to strike a pleading. In the Ripple case, it’s the SEC that’s making an attempt to strike the affirmative protection of Fair Notice and it has the excessive burden to satisfy.

Ripple CEO Brad Garlighouse had remained hopeful on the finish of 2021 as he expressed to CNBC:

Clearly we’re seeing good questions requested by the choose. And I believe the choose realizes this isn’t nearly Ripple, this can have broader implications.

Related Reading | XRP Builds Momentum With 7% Increase As Ripple Launches New ODL Partnership

The Impact On XRP

Related Reading | Ripple Had Its Strongest Year Ever Despite The Sec’s “Attack On Crypto”

The subsequent listening to will likely be a key day for the end result of the Ripple case, thus XRP’s value.

The timing is reasonably difficult for XRP. Its downtrend appears to comply with the overall crypto market motion. XRP is down 2.33% within the final 24 hours to $0,7634 because it reveals within the subsequent chart:

After the SEC filed the lawsuit in opposition to Ripple in December 2002, the XRP value plunged dramatically from $0.60 to $0.1748. It continued to drop and lose floor however stays inside the highest 10 crypto Ranking.

Then, XRP recovered all through 2021 and reached highs of $1.34 on November 10, 2021, though it didn’t handle to shut the 12 months above $1.01.

The XRP fans’ expectations are for Ripple to win the case and XRP to enter a large rally, surging to its all-time excessive of $3.four and even double numbers. However, the earlier projections hadn’t taken into consideration the present crypto market downtrend.

And if the Ripple case have been to have a surprisingly adverse decision, XRP would possibly see an final result simply as unhappy.

[ad_2]

Source link